Our Process

Our Client Onboarding Process

3 Meetings, 3 Months

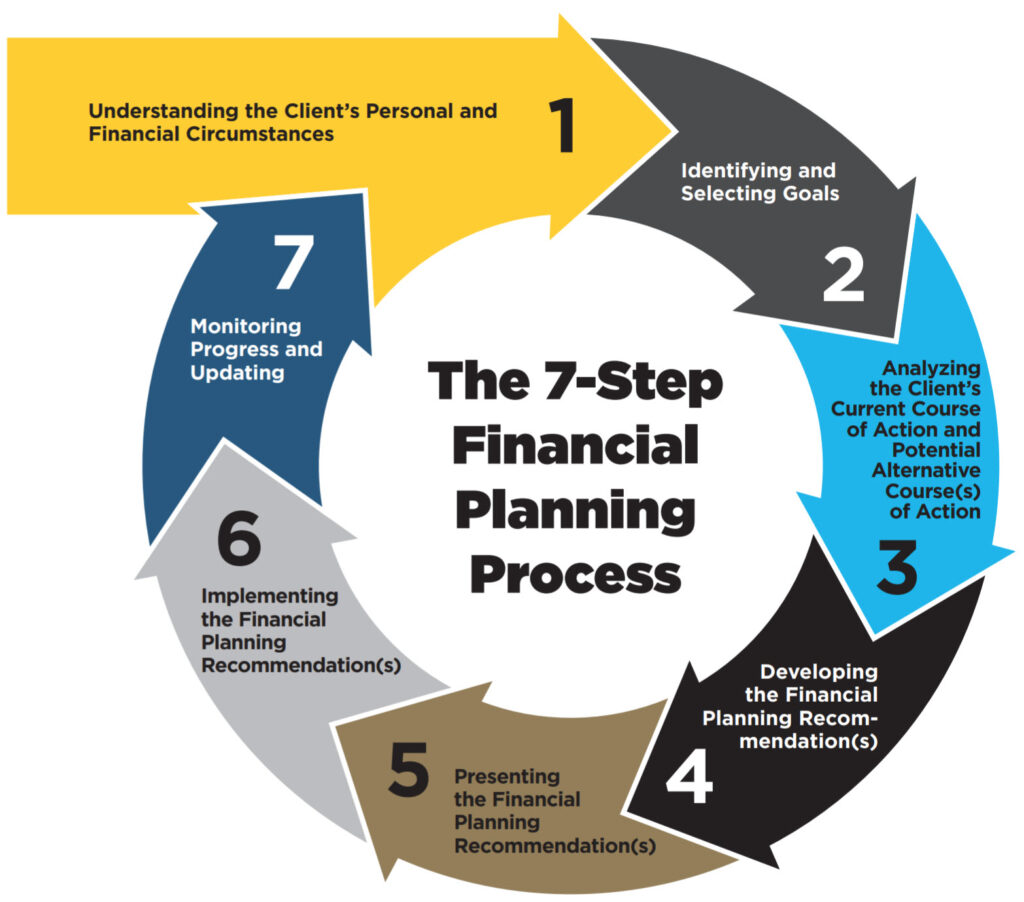

We will typically meet with a new client 3 times to get to our initial recommendations. This is because we want to make sure we understand your situation and goals – What’s important to you before making any recommendations for changes.

In the Discovery meeting we will focus on what’s important to you. Your goals and wishes for the short term and longer term.

After the initial meeting, if we choose to work together then we will need to gather all the detail about for current financial situation

Armed with your goals and data about your current situation, we will develop a draft financial plan. This will help us understand if all of your goals are achievable given your resources or if we need to make some tradeoffs and possibly hard choices about what is most critical to you.

After the Draft Financial Plan meeting, we will develop a written plan of action to help get all your resources aligned with your goals providing you with the best probably of success.

After the onboarding process, we will work with you on an ongoing basis to update your action plan, manage your investment portfolio, and help you respond to all the changes in your life and the external environment (tax and investment laws and innovations).

Our Client Onboarding Process 3 Meetings, 3 Months

(1 hour Virtual/In-Person)

Discovery

(1 hour Virtual/In-Person)

Draft Financial Plan

(1 hour Virtual/In-Person)

Action Plan

We will typically meet with a new client 3 times to get to our initial recommendations. This is because we want to make sure we understand your situation and goals – What’s important to you before making any recommendations for changes.

In the Discovery meeting we will focus on what’s important to you. Your goals and wishes for the short term and longer term.

After the initial meeting, if we choose to work together then we will need to gather all the detail about for current financial situation

Armed with your goals and data about your current situation, we will develop a draft financial plan. This will help us understand if all of your goals are achievable given your resources or if we need to make some tradeoffs and possibly hard choices about what is most critical to you.

After the Draft Financial Plan meeting, we will develop a plan of action to help align your resources with your goals, providing you with a strong probability of success. The onboarding process typically takes about 2 to 3 months, depending on schedules and timeliness of data gathering.

January 1, 2014

1. Set goals

January 1, 2015

2. Assess your resources

January 1, 2016

3. Determine if resources are sufficient to meet your goals

January 1, 2017

4. Develop contingency plans

January 1, 2018

5. Build portfolios to meet your goals

January 1, 2018

6. Monitor your portfolio

January 1, 2018

7. Review your goals and progress

Six core beliefs that drive our process

Planning is essential

Minimize risk

Nobody can predict the future

In aggregate, active management cannot beat the market

Costs matter

Taxes matter

Save your money and time

For Further Inquiries Call

+650-917-3400

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.